kane county illinois property tax due dates 2021

Accorded by state law the government of your city public schools and thousands of various special purpose units are given authority to evaluate real property market value fix tax rates. Batavia Ave Bldg C.

Kane County Il Property Data Real Estate Comps Statistics Reports

630-208-7549 Office Hours Monday Thru Friday.

. Welcome to the Kane County Treasurer E-Notify Service. Clerk of the Circuit Court 540 South Randall Road St. You will need to create an account and have your property tax bill handy.

2021 Tax Code Rate. The median property tax in Kane County Illinois is 5112 per year for a home worth the median value of 245000. The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000.

173 of home value. 2021 Non Ad Valorem District Summary. Tax Year 2021 Second Installment Property Tax Due Date.

Kane County collects on average 209 of a propertys assessed fair. Tax Extension 630-232-5964 John Emerson Director Robert J. You can also pay by credit card or e-check.

Charles Illinois 60174 630-232-3413 Mon-Fri 830AM-430PM. MBA announces that 2021 Kane County Real Estate tax bills that are payable in 2022 are expected to be mailed on April 29. Has yet to be determined.

The best way to search is to enter your Parcel Number or Last Name as it appears on your Tax Bill. Tax amount varies by county. Idor Announces 2021 Kane County Tentative Property Tax Multiplier Kane County Connects.

2021 Revised PTELL Loss in Collection by district summary. You must apply for the exemption with the County Assessment Office. 2021 Estimated EAV Report.

You may sign up with your email address to receive installment due date reminders and payment notifications for. If you would prefer to pay by mail you can send your. Sandner Chief Deputy Clerk.

You can get the 2022 application here or you can call 630-208-3818 and one will be mailed to you. Bldg A Geneva IL 60134 Phone. Township Deadline Date.

Kane County Illinois - Government Website 719 S. The mailing of the bills is dependent on the completion of data by other local and. 2021 Drainage District Summary.

Property Tax Appeal Board. Kane County Treasurer 719 S. If the tax bills are mailed late after May 1 the first installment is due 30 days after the date on.

DUE DATES FOR REAL ESTATE TAX BILLS ANNOUNCED. Kane county illinois property tax due dates 2021 Tuesday March 15 2022 Edit State of Illinois and the third-most populous city in the United States following New York City. Kane county illinois property tax due dates 2021 Thursday May 19 2022 Edit.

In most counties property taxes are paid in two installments usually June 1 and September 1.

What The Gov Will The Coronavirus Pandemic Affect Your Property Tax Bills Better Government Association

Cook County Property Tax Bills In The Mail This Week

Property Taxes City Of St Charles Il

Property Tax Rebate Program Montgomery Il Official Website

Elder Law Attorney Near Me Kane County Il 847 628 8311

2021 Lake County Property Tax Appeals Mchenry County Lawyers

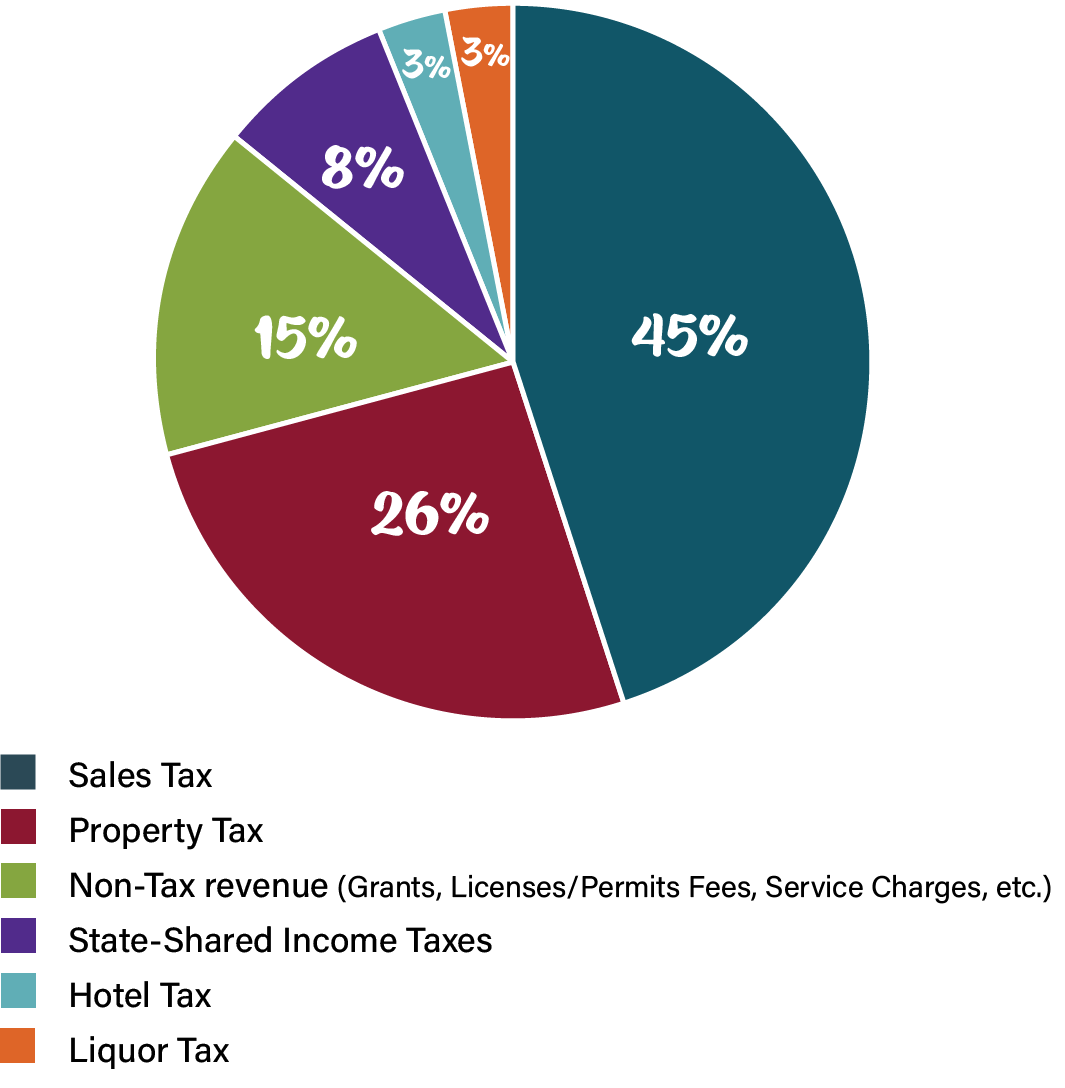

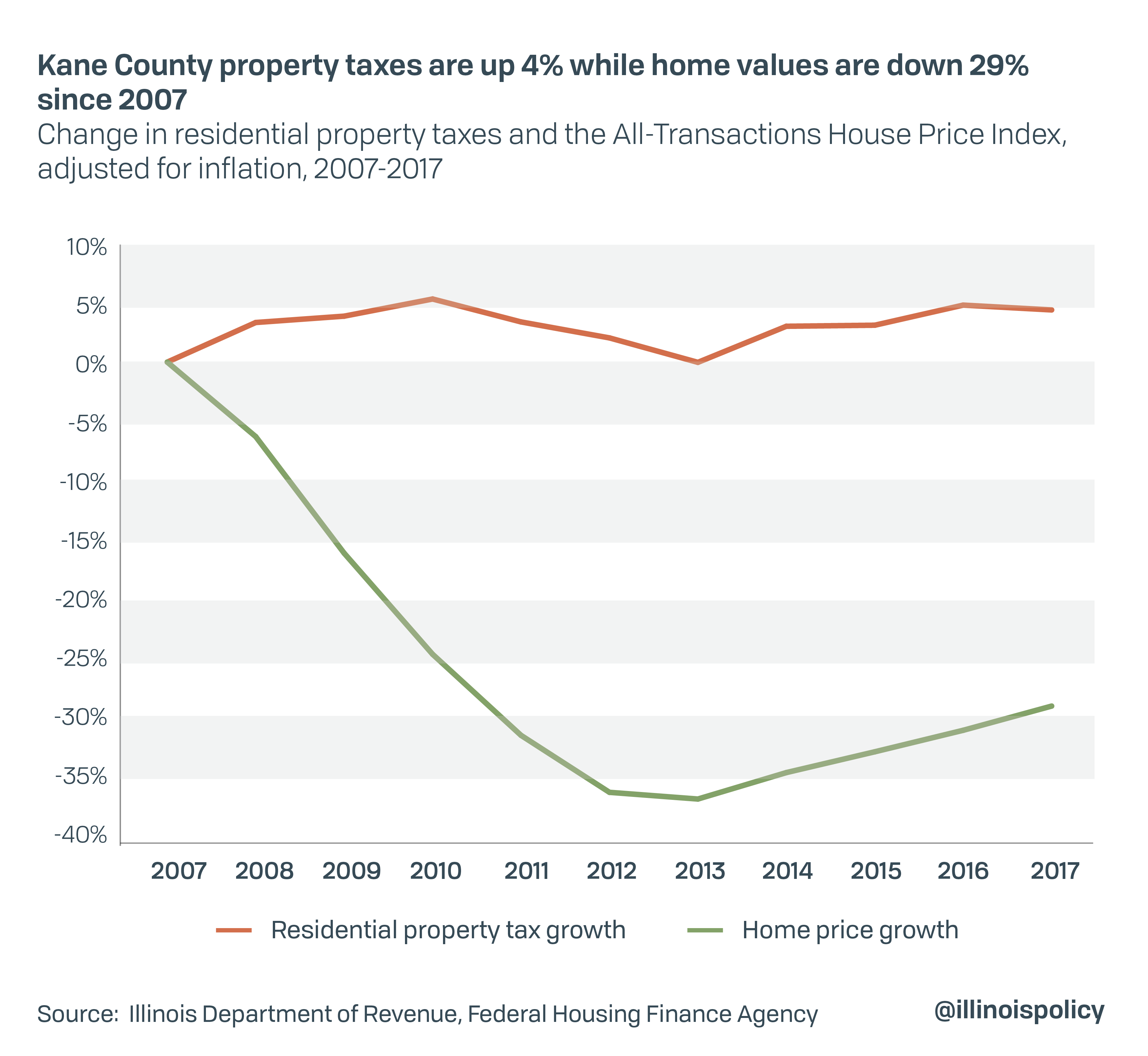

Kane County Home Values Down 29 Property Tax Up 4 Since Recession

Eminent Domain Condemnation Attorneys In Kane County

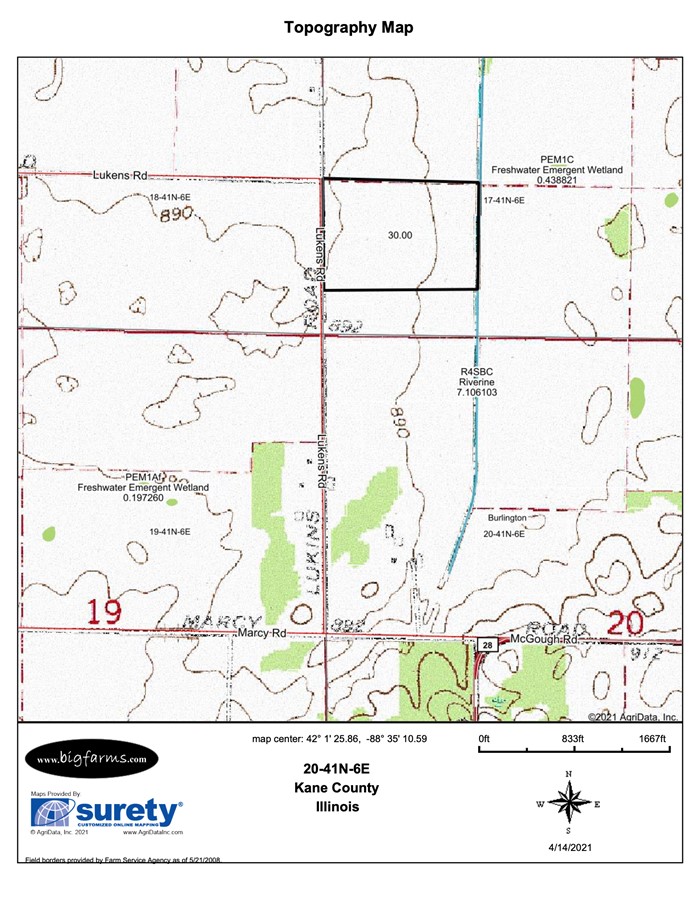

Property For Sale Sycamore Il Kane County 30 Acre Janes Farm Burlington Township

/cloudfront-us-east-1.images.arcpublishing.com/gray/OTPM65KTANC3RPCFWHLLZGQXUU.PNG)

Illinois Republicans Claim Safe T Act Will Cause Property Tax Hikes

Kane County Property Tax Appeals

Dupage And Lake County Tax Bills Starting To Arrive Chicago Real Estate Closing Blog

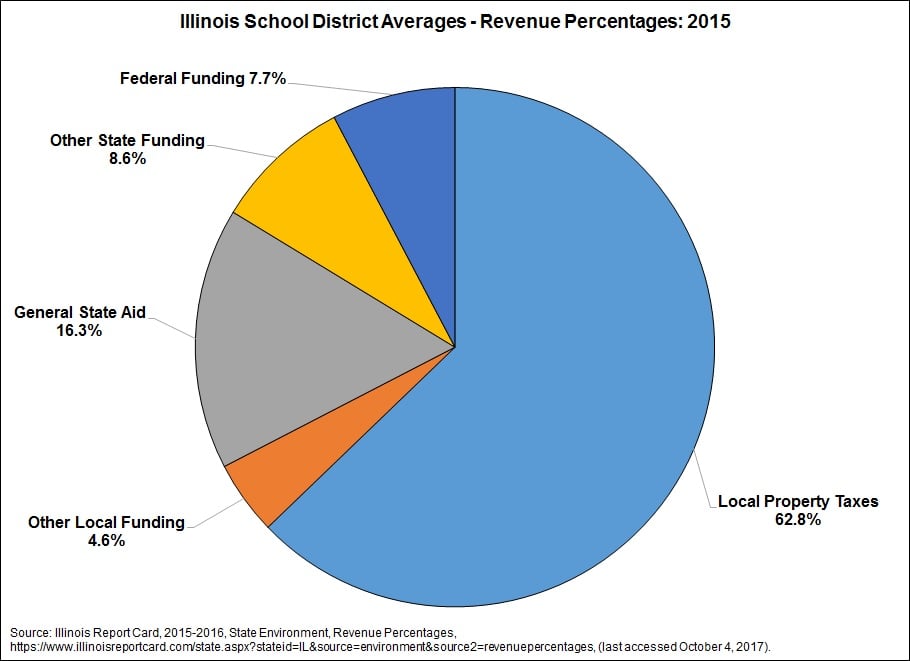

School Districts And Property Taxes In Illinois The Civic Federation

Mchenry County Real Estate Tax Bill

Divorce Papers Kane County Il Free Call 847 628 8311

Dupage County Residents Pay Some Of The Nation S Highest Property Tax Rates

Illinois 2022 Primary Election Voter Guide Wbez Chicago

Retirees Need To Take Action For Latest Property Tax Rebate Npr Illinois